Calculate my dti

In most cases lenders want total debts to account for 36 of your monthly income or less. Determine your total monthly income before taxes.

Debt To Income Ratio Calculator Excel Pal

Calculate your DTI by dividing your total monthly debt payments by your total monthly gross income your income before taxes.

. The debt-to-income formula is simple. Debt to income ratio - what is it. Your monthly debt expenses for the back-end ratio are 2375.

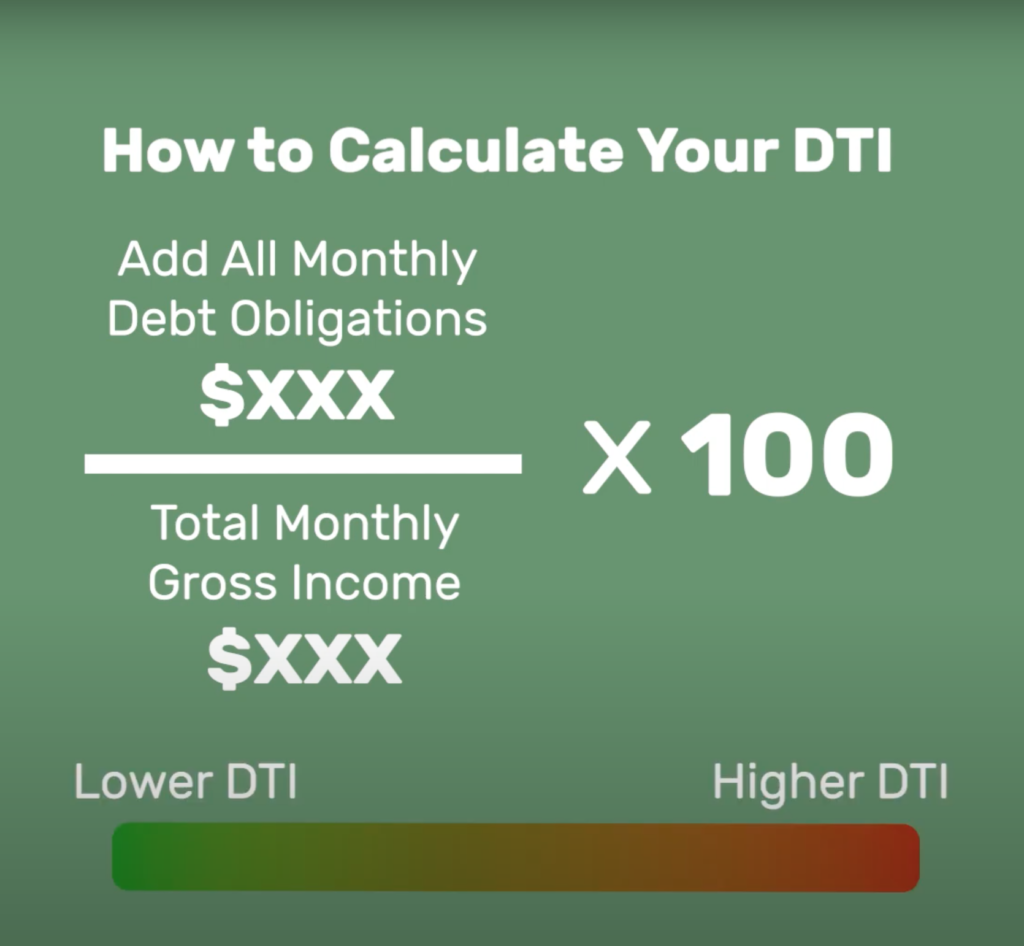

Total debt divided by gross monthly income times 100. To calculate your DTI ratio you need to know both your monthly income and your total monthly debt payments. Your gross monthly income is the money you have earned in a.

Your debt-to-income ratio is a great way to look at how financially healthy you are basically. Usable income depends on how you get paid and whether you are salaried or self-employed. How to Improve Your Debt-to-Income Ratio.

To calculate your DTI add up all of your monthly debt payments and divide them by your gross monthly income. For example if your total monthly debts. Total monthly debt payments divided by total monthly gross income before taxes and other deductions.

Then multiply that number by 100. To calculate your debt-to-income ratio add up all of your monthly debts rent or mortgage payments student loans personal loans auto loans credit card payments child support. You divide 2375 by 10500 which sets out to be 0226.

A higher DTI means more of your income is going. Lets say you have a total monthly debt. Calculate your DTI with the following formula.

DTI is calculated by dividing your monthly debt obligations by your pretax or gross income. The debt-to-income ratio also known as DTI is a measurement of your monthly debt obligations compared to your gross monthly income. When youre applying for a mortgage improving your debt-to-income ratio can make a difference in how lenders view you.

To calculate your DTI enter the payments you owe such as rent or mortgage student loan and auto loan payments credit card minimums and other regular payments. Divide your total monthly debt payment by. Add up your monthly debt payments to determine your total monthly debt.

Several steps can help. Click the Calculate DTI Ratio button to see the results. If you have a salary of 72000 per year then your usable income for purposes of calculating.

The Debt to Income Ratio Formula. To put it simply your DTI is a comparison between how much you owe and how much you make on a monthly basis. Your monthly gross income is 10500.

A low DTI ratio is preferable since it indicates a higher likelihood. Your DTI is one of the most important metrics that lenders.

Debt To Income Ratio Formula Calculator Excel Template

Debt To Income Ratio Calculator For Mortgage Approval Dti Calculator

Debt To Income Ratio Can You Really Afford That Car Or Home Money Life Wax Debt To Income Ratio Student Loans Student Loan Help

How To Calculate Your Debt To Income Ratio

/dti.asp_final-3c479261d089403fa2a781100b1e34dc.png)

Debt To Income Dti Ratio What S Good And How To Calculate It

Debt To Income Ratio Dti Calculator

High Dti Mortgage Lenders For 2022 High Dti Solutions Mortgage Lenders Mortgage Tips Mortgage Process

What Is The Debt To Income Ratio Learn More Citizens Bank

Mortgage Calculator With Taxes Insurance Pmi Hoa Extra Payments Mortgage Payment Calculator Mortgage Amortization Calculator Mortgage Calculator App

Understanding Dti And How It Impacts Your Chances Of Getting A Loan Or Credit Card Mid Hudson Valley Federal Credit Union

8 Real Estate Rules That May Have Changed Since You Bought Your House Debt To Income Ratio Adjustable Rate Mortgage Consumer Debt

How To Calculate Debt To Income Ratio

Your Debt To Income Ratio Is All Your Monthly Debt Payments Divided By Your Gross Monthly Income This Number Is Debt To Income Ratio Home Buying Process Debt

Everything You Need To Know About The Pre Approval Process For Buying A Home Debt To Income Ratio Debt Free Debt

How To Calculate Your Debt To Income Ratio Lendingtree

/dti.asp_final-3c479261d089403fa2a781100b1e34dc.png)

Debt To Income Dti Ratio What S Good And How To Calculate It

Pin On Three Five